Magazine

Best Coworking Spaces in Amsterdam: Your Complete Guide

Mindspace

28 June, 2025

Discover Amsterdam's top coworking spaces. Mindspace leads with premium locations at Dam, Herengracht & House. Compare amenities, pricing & more.

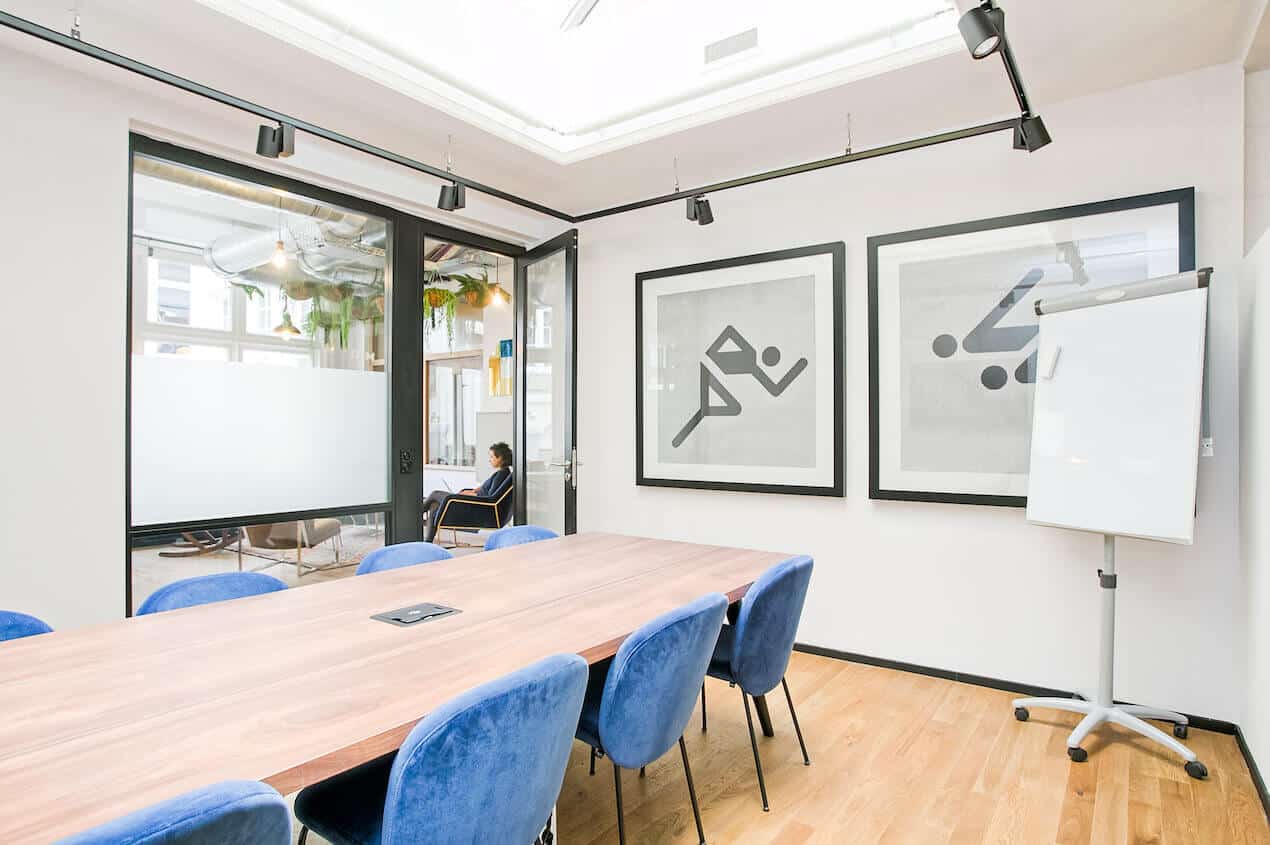

Best Meeting Rooms in Amsterdam for Creative Teams & Corporate Events

Mindspace

27 June, 2025

Find premium meeting spaces in Amsterdam including Mindspace's acclaimed Dam & House venues. Perfect for creative professionals & corporate events.

Benefits of Shared Office Space for Law Firms

Mindspace

25 June, 2025

Discover how shared office spaces transform law firm operations. Reduce costs, enhance flexibility, and access premium amenities for legal practices.

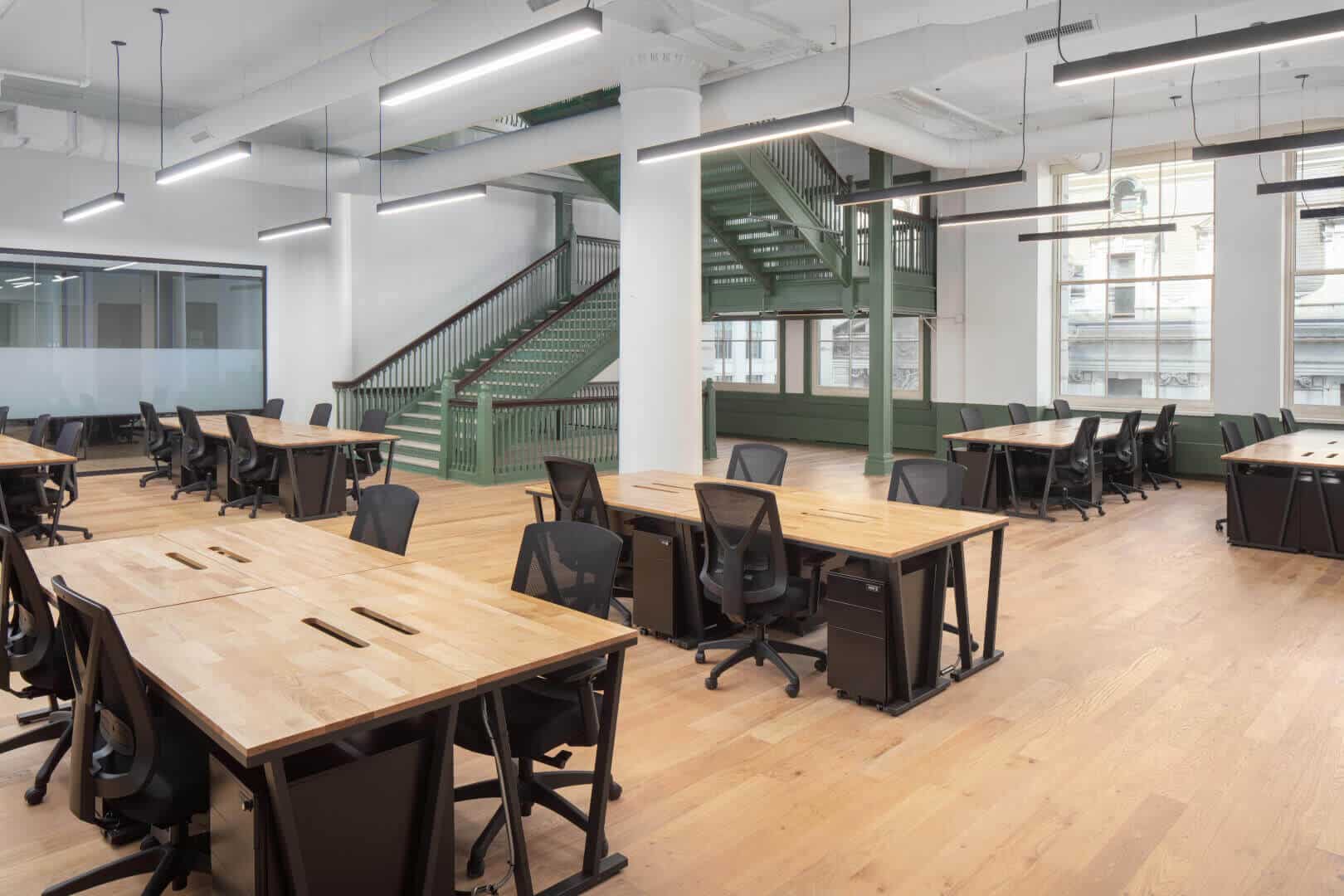

Best Office Layout for a 50+ Person Team

Mindspace

17 June, 2025

Design the perfect office layout for large teams. Expert guidance on space planning, collaboration zones, and productivity optimization for 50+ employees.

The Rise of Resimercial Office Design

Mindspace

12 June, 2025

Explore the resimercial trend transforming office environments. See how home-like comfort enhances workplace productivity and employee wellness.

Best Work Social Ideas for Team Building

Mindspace

10 June, 2025

Discover creative work social ideas that boost team morale and productivity. From office events to flexible workspace activities for stronger teams.

What to Consider when Planning an Office Move for 50+ Employees

Mindspace

7 June, 2025

Master your office relocation with our comprehensive guide. Expert tips for moving 50+ employees, timeline planning, and cost considerations.

Coworking Space vs. Traditional Offices: What's the Difference?

Anat Zilberman

4 June, 2025

Read on as we examine the differences between opting for a coworking space vs. a traditional office.

Private Office Spaces: Premium Workspace Solutions for Growing Businesses

Mindspace

28 May, 2025

Mindspace delivers thoughtfully designed private offices that balance professional aesthetics with practical functionality, creating environments where teams can thrive.

The Best Coworking Spaces in Shoreditch: A Complete Guide

Mindspace

27 May, 2025

Discover Shoreditch's best coworking spaces including Mindspace. Find the perfect flexible workspace in East London's creative hub.

How to Find Small Office Space for Rent

Mindspace

26 May, 2025

Discover how to find the perfect small office space for your business with our expert tips on location, budgeting, and flexible workspace solutions.

Best Meeting Rooms in Miami: Your Guide to Professional Meeting Spaces

Mindspace

24 May, 2025

Discover Miami's best meeting rooms for your business needs. Mindspace offers professional, fully-equipped spaces in prime locations. Book your perfect room today.

Renting Private Office Spaces: The Ultimate Guide for Businesses

Mindspace

22 May, 2025

Discover Mindspace's private office solutions designed for productivity and growth. Flexible terms, premium amenities, and global locations for your business.

How to Rent Office Space in London: A Complete Guide

Mindspace

21 May, 2025

This guide covers everything from traditional long-term leases to those trendy coworking spots you've probably walked past.

Coworking in Amsterdam: Where Innovation Meets Dutch Design

Mindspace

20 May, 2025

The coworking scene in Amsterdam has evolved a lot over the recent years. Let's explore together and see where to find the best places.

Amsterdam Event Spaces: Finding Your Perfect Venue

Mindspace

16 May, 2025

If you're considering Amsterdam for your next event, you're onto something good. The city somehow manages to be both charming and completely functional, which is rarer than you might think in event planning!

What to Expect from a Furnished Office

Mindspace

13 May, 2025

We’ll take a closer look at exactly what a furnished office is, the benefits of using one, and what to consider when choosing the perfect space for your needs.

How San Francisco's Office Space Market is Adapting to Post-Pandemic Work Trends

Mindspace

12 May, 2025

The pandemic has reshaped the nature of work and work environments globally. These seismic changes have been particularly felt in places like San Francisco, with the US city experiencing high vacancy rates, declining rental rates, and a noticeable shift towards flexible and hybrid work. Fortunately, San Francisco has managed to weather the storm reasonably well, with its position as a major tech hub and innovator central to its enduring success.

Open Office vs Cubicle - Which is Best for Productivity?

Mindspace

10 May, 2025

If you’re looking to rent an office for the first time, you’ll want to seriously consider layouts before signing and finalizing a lease.

How Small Businesses Are Winning the Talent War with Hybrid Work Policies

Mindspace

8 May, 2025

In today's job market, small businesses have to get creative to attract top talent. With bigger companies often offering larger salaries and extensive benefits, smaller businesses need to highlight their own unique advantages. One of the best ways to do this is by embracing hybrid-friendly work policies.

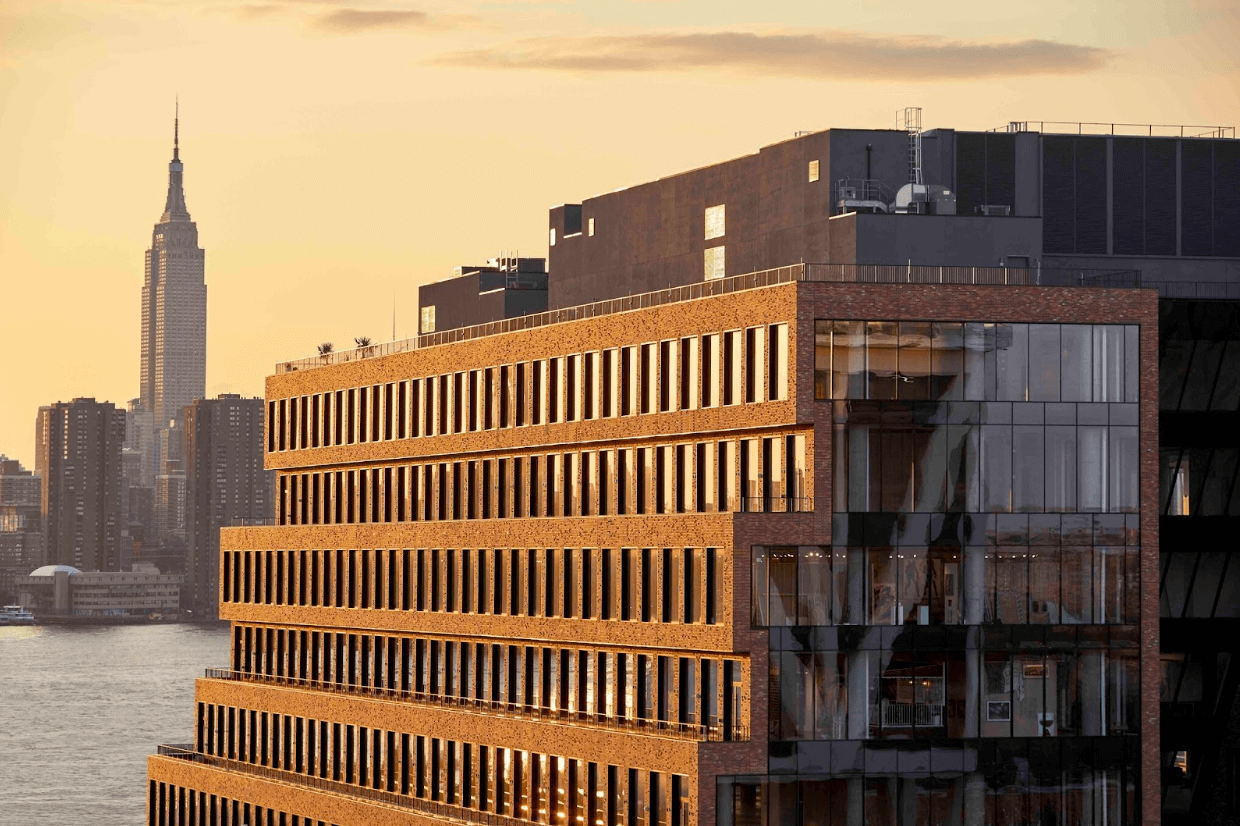

Why Williamsburg Is the New Hub for Creative Office Spaces in New York

Mindspace

5 May, 2025

Williamsburg has become a prime destination for professionals in NYC, thanks to its thriving creative scene, excellent transport links, and trendy amenities. As a hub for innovation, the neighborhood has seen a surge in businesses, particularly in the creative industries. With a wide range of office options - from coworking spaces to traditional setups - Williamsburg offers the perfect environment for professionals looking to establish themselves in the city.

The Role of Coworking Spaces in Amsterdam's Start-up Ecosystem

Mindspace

1 May, 2025

Amsterdam has earned its reputation as a leading European startup capital, with coworking spaces playing a crucial role in this achievement.

What is a Shared Office Space? The Complete Office Guide

Mindspace

1 May, 2025

What is a shared office space? Essentially, it’s a workspace that’s intended to be utilized by more than one person. A coworking space may have dozens, if not hundreds, of individual freelancers working alongside each other in an open-plan interior.

Commercial Sublease vs Traditional Lease vs Coworking: Differences

Mindspace

30 April, 2025

Main differences between Commercial Sublease vs Traditional Lease vs Coworking- what will be the best business solution for you?

The Demand for Office Space for Rent in Washington DC: Key Factors Driving Growth

Mindspace

28 April, 2025

Washington DC has long been a business hub, home to government agencies and major industries. Recently, demand for office space has shifted from traditional setups to more dynamic spaces that support remote and hybrid work models. Let’s explore the current trends shaping the market and what’s driving this change.

How Miami’s Coworking Spaces Support Remote Workers and Digital Nomads

Mindspace

21 April, 2025

Freelancing offers freedom, but digital nomadism takes it to the next level—working from anywhere in the world. If you're seeking your next stop, Miami is a top choice. With its vibrant culture, warm weather, and booming tech scene, the city is a haven for remote workers. Plus, Miami’s coworking spaces are thriving, offering plenty of options for digital nomads. Let’s explore what makes them stand out.

Amsterdam Office Space: The 2025 Transformation Guide

Mindspace

16 April, 2025

Amsterdam's office landscape undergoes significant changes as companies reimagine workplace requirements. Businesses across the Dutch capital embrace shared workspace solutions, signaling a structural shift in commercial real estate preferences. This fundamental change reshapes how organizations view and utilize physical workspaces.

How Remote Work is Shaping San Francisco’s Coworking Spaces

Mindspace

14 April, 2025

San Francisco is widely recognized as the birthplace of coworking. The concept was born here, with the first coworking spaces emerging in the early 2000s. Since then, the city has played a pivotal role in shaping the coworking movement, driving some of its most significant innovations. Curious about what makes coworking in San Francisco so special? Let’s explore what the city’s coworking spaces have to offer, how the industry has evolved, and what the future holds.

Everything You Need to Know About Private Office Rentals

Mindspace

7 April, 2025

Private office rentals are becoming an increasingly popular choice for businesses seeking a dedicated workspace. Often located within larger coworking environments, these offices provide the stability of a traditional lease without the hidden costs, while offering greater flexibility. Beyond affordability and flexibility, private offices offer additional advantages. Employees benefit from access to shared amenities that enhance productivity, while open-plan areas and communal spaces foster collaboration. Interested in unlocking the benefits of private office rentals? Let’s explore why they could be the perfect next step for your business.

Best Event Spaces in Philadelphia to Host Amazing Experiences

Mindspace

2 April, 2025

In our list, we’ll cover everything from historic venues in some of Philly’s oldest districts to outdoor spaces and offbeat venues for unforgettable events.

Elevate Your Leadership: Mastering the Art of Managing Remote Teams

Mindspace

1 April, 2025

In the U.S., approximately 20% of employees now work remotely, and around 71% of employers have adopted a hybrid work model. These shifts have made effective remote team management more crucial than ever. While remote work offers significant advantages for both businesses and employees, its success depends on strong leadership. In this guide, we’ll explore the challenges remote teams face, the essential skills of a great remote manager, and best practices for leading distributed teams effectively.

What is Coworking? Coworking Spaces Explained

Mindspace

30 March, 2025

An increasing number of professionals are moving away from traditional office setups, embracing coworking spaces as the new norm. Despite some myths surrounding these shared work environments, the truth is they offer a dynamic setting ideal for boosting productivity, networking with like-minded individuals, and fostering meaningful partnerships and opportunities. But what exactly is a coworking space? How did this movement begin? And what should you consider when selecting the perfect space for your business? Let’s dive into these questions and more to uncover the full potential of coworking spaces.

Why Private Office Rentals Are on the Rise for Hybrid Teams in Washington, DC

Mindspace

10 March, 2025

Hybrid teams are rapidly becoming the standard in today's workplace. Driven by flexibility, increased productivity, and cost savings, companies are increasingly embracing this model. Washington, D.C.'s office spaces are evolving to meet this growing demand. Hybrid work offers a superior work-life balance, expands access to talent, and fosters collaboration between remote and in-office employees, avoiding the drawbacks of fully remote or traditional coworking setups. If you're seeking hybrid office space in D.C., our guide provides essential insights.

The Most Inspiring Workspaces in Miami

Mindspace

4 March, 2025

Coworking spaces are a sought-after solution for Miami's startups and those adopting hybrid work models. They deliver comprehensive business amenities and a full range of facilities for freelancers, along with vital networking opportunities. If you're seeking a new business hub, we'll guide you through what to prioritize when choosing an inspiring workspace, and highlight some of Miami's leading options.

Coworking Trends: Future of Flexible Workspaces in 2025 and Beyond

Mindspace

26 February, 2025

Coworking spaces are increasingly popular. Offering a cost-effective and environmentally friendly alternative to traditional offices, coworking is often seen as the future of work, particularly as companies prioritize flexibility. The shared workspace sector is constantly evolving, driven by technological advancements, new work models, and innovative design. Let's examine the key coworking trends shaping the market in 2025 and beyond.

How to Get a Virtual Business Address - Types and Benefits

Mindspace

19 February, 2025

Remote work is now mainstream, offering cost savings for both individuals and companies. While the traditional office is fading, the need for some form of workspace remains. Whether it's shared office facilities or a registered business address, a completely remote operation is rarely feasible. Virtual offices provide a flexible solution for remote-first companies, with a virtual business address being a key benefit. We'll explore virtual offices in detail, highlighting their advantages and explaining how to obtain a virtual business address.

Office Relocation Guide: Embracing Shared Workspaces for Flexibility and Growth

Mindspace

12 February, 2025

Businesses are moving away from traditional leases, and freelancers are seeking innovative work environments. Coworking spaces offer an ideal alternative for those considering an office relocation. They provide greater flexibility than standard leases, are cost-effective, and foster collaboration while offering access to top-notch facilities. Our office relocation guide has all the information you need to explore shared workspaces.

Great Teamwork: The Secret Sauce for Success in Modern Workplaces

Mindspace

7 February, 2025

Successful businesses thrive on great teamwork. Collaboration benefits everyone: employees find greater job satisfaction and professional growth, while businesses enjoy happier customers, increased productivity, a stronger brand, and higher profits. This exploration will delve into the essential elements of effective teamwork, how to foster a collaborative environment, and the characteristics of high-performing teams.

12 Best Coworking Spaces in Miami - Our Top Picks

Mindspace

15 January, 2025

If you're searching for a flexible and inspiring place to work remotely, coworking spaces offer the perfect solution. Looking for guidance on finding the best coworking spaces in Miami? Our comprehensive guide covers everything you need to know, along with a curated list of top coworking spaces in the city to explore.

20 Work Social Event Ideas for a Strong Company Culture

Mindspace

8 January, 2025

A strong company culture boosts employee morale, enhances productivity, and strengthens your brand, attracting top talent and clients alike. One of the easiest ways to foster this is through engaging social events. Looking for inspiration? Check out these 20 work social event ideas to elevate your team’s connection and energy.

How to Rent an Office Space: A Step-by-Step Guide

Mindspace

8 January, 2025

Whether you're securing your first office or expanding your operations, the process can feel daunting. Finding the perfect location requires a clear understanding of the options available, from traditional office setups to hot-desking solutions for businesses embracing hybrid work environments. We’ve put together a quick guide on finding the perfect office space and avoiding common first-time leasing mistakes.

AI Gold Rush: The Impact of Tech Expansions on San Francisco's Office Vacancy Crisis

Mindspace

2 December, 2024

San Francisco’s office vacancy crisis is seeing a potential turnaround, thanks to the rise of Artificial Intelligence. Once challenged by the pandemic's shift to remote work, the city is witnessing renewed office demand as AI startups and tech giants invest heavily in innovation. Flexible workspaces, like Mindspace, are stepping up to meet this demand, offering scalable and collaborative environments tailored to hybrid teams. With San Francisco reasserting its status as a global tech hub, the AI gold rush is not just reshaping industries but also revitalizing the city’s commercial real estate landscape.

The Ultimate Guide to Coworking in Amsterdam

Mindspace

12 November, 2024

Coworking spaces have been transforming the way people work since the mid-1990s, and Amsterdam is at the forefront of this trend. Today, the city offers hundreds of flexible workspaces for freelancers, small businesses, and startups. The Dutch coworking market, valued at $243 million in 2023, is projected to exceed $785 million by 2030. With options ranging from open-plan layouts ideal for networking to dedicated and hot desks, Amsterdam's coworking scene offers something for everyone. Thinking of making the leap? Discover why Amsterdam could be the perfect base for your next big idea.

Why a Coworking Space in Utrecht Can Accelerate Your Business Growth

Mindspace

11 November, 2024

Utrecht offers a cost-effective alternative to Amsterdam, attracting small and growing businesses with its affordable rents and strategic location near the Dutch capital. This vibrant city is now a hub for startups, tech companies, and sectors like digital media, sciences, and health. Even established firms are choosing Utrecht for its flexibility and scalability, supported by a wide range of flexible workspaces.

The Most Wanted Office Amenities Requested by Employees in 2024

Mindspace

5 November, 2024

While compensation is undoubtedly a key factor in employee satisfaction, it's not the sole determinant. Flexible work options and enticing office amenities, such as those provided by coworking spaces, are gaining significant traction. As businesses compete for talent, they must be creative in meeting the evolving needs of their workforce. Read our article, where we explore the most wanted office amenities in 2024 and why it continues to be crucial for businesses to listen — and adapt.

Brooklyn: The New Hub for Startups and Coworking—What’s Fueling the Shift?

Mindspace

23 October, 2024

While Manhattan has long dominated New York City's startup scene, Brooklyn is gaining ground. Its affordability, accessibility, and relaxed atmosphere are attracting entrepreneurs seeking a thriving yet less hectic environment. Despite its lower costs, Brooklyn offers top talent, a vibrant tech ecosystem, and growing venture capital connections. Why is Brooklyn the new startup hotspot? Discover the secrets to success in this rising tech hub.

Venture Capital in Miami: Your Guide to the Key Players on the Scene

Mindspace

18 October, 2024

Miami's reputation as a vibrant city known for its nightlife and sun-soaked beaches is rapidly evolving. It has emerged as a dynamic hub for entrepreneurs and investors, offering a thriving tech scene and abundant venture capital opportunities. The city's growing ecosystem provides startups with the ideal environment to scale and succeed, making it a compelling destination for those seeking to launch or grow their businesses.

A Guide to Choosing a Coworking Space in Downtown Miami

Mindspace

9 October, 2024

Whether you’re a budding startup or a seasoned professional, our modern design, exceptional amenities, and vibrant community offer the ideal environment to elevate your productivity and inspire your success. Let’s dive in and see why Mindspace is the perfect choice for you.

Coworking vs. Traditional Office: Why Flexibility Matters for Miami Startups

Mindspace

7 October, 2024

As Miami's startup ecosystem thrives with an influx of tech talent, entrepreneurs, and investors, the demand for flexible, cost-effective workspaces is on the rise. While traditional offices have been the standard for businesses, startups are increasingly turning to coworking spaces for their flexibility and scalability. In this guide, we compare coworking spaces and traditional office options to help you choose the best solution for your startup's growth and success.

Top Benefits of Renting Office Space in Amsterdam

Mindspace

23 September, 2024

Amsterdam is a top business hub in Europe, attracting companies with its central location and excellent public transport. Over 130,000 businesses, including major names like Booking.com, SPAR, Endemol, and Heineken, have established their offices in the Dutch capital. However, as Amsterdam's appeal continues to grow, so do the costs of renting office space. Prime areas like Centrum and Zuidas feature some of the city's most expensive options, often pricing out startups and smaller companies. Still, there are plenty of more affordable areas across the city offering excellent alternatives. Read on to explore office rental options, amenities, and pricing in Amsterdam.

Breaking Down the Cost of Office Space in Downtown Miami: What to Expect

Mindspace

10 September, 2024

If you're seeking office space in Downtown Miami, you likely already know that the city is a hotspot for businesses of all sizes, driven by its booming tech industry, robust infrastructure, cultural diversity, and favorable tax environment. To help you explore your options and save on office space, we've outlined the available types and their associated rental costs so you can find the best fit for your business and budget.

Downtown Miami vs Brickell Office Space Showdown: Which Location Is Best for Your Company?

Mindspace

2 September, 2024

Are you looking for office space in Miami? Two key neighborhoods offering the best office locations in Miami are Downtown and Brickell, located just south of Downtown. To help you make the best decision for your company before you put down any roots, we’ve created a guide to the office space showdown between Downtown Miami and Brickell.

Affordable Meeting Room Solutions for Startups in Downtown Miami

Mindspace

27 August, 2024

Are you the owner of a startup navigating the early stages of growth? It’s no secret that strategic investments in your business are critical to long-term success. One important investment that often gets overlooked is having a dedicated meeting space. The right meeting environment can drive collaboration, foster creativity, and help you build a strong company culture while making a good first impression on investors and clients.

Downtown Miami vs. South Beach: Which is the Best Place to Live and Work?

Mindspace

22 July, 2024

Whether you're a current Florida resident considering a move within the state or relocating from further away, don't overlook Miami. Known for its vibrant atmosphere and endless opportunities, Miami rivals New York City in its energy and sleepless nights. It’s an ideal destination for those seeking career and business prospects in a city that offers warm weather year-round.

The Perks of Coworking at Mindspace Downtown Miami

Mindspace

26 June, 2024

Intrigued by the energy of Downtown Miami? You're not alone. Beyond the vibrant atmosphere and scenic beauty, this area boasts a thriving business scene where startups and established companies come together. Mindspace is proud to offer coworking solutions in this dynamic hub. Let's delve into the benefits of working in Downtown Miami, and the perks you'll enjoy as a Mindspace member.

Our Go-To Downtown Miami Breakfast Hotspots

Mindspace

6 June, 2024

Where will your breakfast quest lead you today? Fortunately, Downtown Miami is brimming with options for mouthwatering morning feasts. Finding breakfast here is as easy and delightful as parasailing along South Beach or biking on the Venetian Causeway. Discover our favorite breakfast spots in downtown Miami, where you can enjoy delicious morning meals, from classic American breakfasts to trendy brunch dishes.

Mindspace's Top Picks for Brunch in Williamsburg, Brooklyn

Mindspace

31 May, 2024

Escape the ordinary and dive into Williamsburg's vibrant brunch scene. Whether you crave classic eggs or are seeking global flavors to tantalize your taste buds, this Brooklyn neighborhood offers endless possibilities. From intimate cafes with a laid-back atmosphere to trendy restaurants pulsating with energy, there's a perfect spot for every mood and craving.

Strategic Moves: How to Relocate Your Business to Miami

Mindspace

28 May, 2024

Thanks to its coveted climate and lifestyle, Miami has emerged as a magnet for entrepreneurs, investors, and big-wig brands. But the city is no longer just a destination for sun-seekers and beach-goers; Miami has become a bustling hub of commerce and innovation in recent years, with a business landscape that pulsates with energy. From startups to Fortune 500 companies, the Miami business environment is reflective of the city’s dynamic and diverse population.

Top Restaurants in Wynwood, Miami to Try on Your Lunch Break

Mindspace

17 May, 2024

Wynwood, Miami is a vibrant hub known for its ever-changing energy. It's no wonder it's a popular place to work! Whether you're short on time or craving a beautiful outdoor lunch break, Wynwood's restaurants have you covered. With most options close to offices and co-working spaces like Mindspace Wynwood, finding the perfect midday meal is a breeze.

Miami Startup Scene: The Roadmap to Success

Mindspace

27 March, 2024

In recent years, Miami has emerged as a shining star in the constellation of global startup hubs. With its vibrant culture, favorable climate, and business-friendly environment, the Magic City has become a magnet for entrepreneurs and investors alike. From tech startups to creative ventures, Miami's startup scene is bustling with energy and innovation, poised to rival even the most established hubs around the world. In this blog post, we'll delve deeper into the Miami startup ecosystem, exploring the factors driving its exponential growth. Join us as we uncover the secrets behind Miami's ascent as a powerhouse of innovation and entrepreneurship.

Beyond the Desk: Brooklyn’s Top Gyms for the Modern Professional

Mindspace

27 February, 2024

In the hustle and bustle of Brooklyn, where the urban landscape meets the thriving professional scene, maintaining a healthy lifestyle is paramount for the modern professional. As the demands of work continue to increase, finding the right gym becomes crucial – it's not just about fitness, but also about convenience, amenities, and a supportive environment. Whether you're seeking a place to unwind after a stressful day or looking to kickstart your fitness journey, Brooklyn offers a diverse range of gyms tailored to meet the needs of the contemporary professional. In this comprehensive guide, we'll explore some of the top gyms in Brooklyn, highlighting their unique selling points, so you can make an informed decision that aligns with your fitness goals and lifestyle.

Tech Conferences in Miami to Look Out for in 2024

Mindspace

8 February, 2024

Miami is emerging as a prominent global tech hub, and 2024 promises to be an exciting year for tech enthusiasts with a line-up of cutting-edge conferences. From artificial intelligence to data science and everything in between, Miami is set to host a variety of tech events that will shape the future of the industry. Whether you’re looking to mingle, launch a new product, gain brand awareness or get up to speed with the latest tech developments, here’s the low-down on 11 must-attend tech conferences in the Magic City.

Office Hoteling: Where Work Meets Wanderlust

Mindspace

28 January, 2024

In the era of remote work and flexibility, the traditional office setup is getting a facelift with the rise of hoteling office spaces. This comprehensive guide will delve into the intricacies of office hoteling, exploring its benefits, drawbacks, best practices, and considerations to help you determine if it's the right fit for your business.

Top spots for remote work in Philadelphia: coffee shops & beyond

Mindspace

22 January, 2024

There are so many things I love about Philadelphia. Whether you’re a history buff or a lover of music, the city has so much to offer. The people are welcoming, the museums are amazing and the city is so walkable I spend many a weekend meandering through its parks and quiet streets. It might be the sixth largest city in America, but it’s retained a small town charm, which makes it a great place for remote working. As a Community Manager at Mindspace Wanamaker, it’s my job to be clued up on where the best places to eat, sleep and drink coffee are.

What You Need to Start a Business in Philadelphia

Mindspace

21 January, 2024

With a reputation for supporting the underdogs, the city of Philadelphia is an exciting place to kick-start your own venture. Often overshadowed by the likes of New York or the Silicon Valley, most people don’t realize that Philadelphia, home to over a dozen Fortune 500 businesses and several world-class VCs, offers excellent networking and funding opportunities. Add oodles of local talent and a hustler mentality into the mix, and you’ve got yourself the ideal location for starting a business. Philadelphia is also one of the best cities in America for coworking - our own Mindspace Wanamaker being a local favorite among startups.

Where to work remotely in Miami: remote workers’ favorite spots

Mindspace

10 December, 2023

If you’re looking to ditch the nine to five grind and work remotely, there’s no better place to be than Miami. Boasting beautiful beaches, a fabulous nightlife and a contagious joie de vivre, the tax free haven is a popular hotspot for digital nomads. As a city bursting with fabulous coffee shops, restaurants, hotel lobbies and coworking spaces to work in, it's difficult to know where to head to tackle that hefty workload. That's why we've put together a simple guide detailing our pick of the best ones for remote working.

Top 5 Unique and Creative London Meeting Rooms

Mindspace

10 December, 2023

Running a business in the commercial nerve center of Europe can be a daunting task. Whether you're an entrepreneur pitching to win your first client or a multinational arranging a team brainstorm, one things's for sure - you'll need to find the perfect meeting room. Here is a sneak peek into some of the fabulous meeting rooms available at Mindspace locations across London. No matter whether you're looking for professional or casual, quirky or swanky, we've got you covered.

The Fashion for Flex Space: Office Space Alternatives for 2024

Mindspace

8 December, 2023

These days you don’t have to be rebellious to opt for an alternative kind of office space. The emergence of flex office spaces and coworking hubs have opened the door to a new world of workplaces. With the use of more experimental interior design, and the inclusion of contemporary artwork, collections of vintage objects, neon signs, bright colors and plenty of foliage and fun signage, the world of work has had a dramatic makeover. Now that there is a variety of flexible office options available, the challenge is how to choose the right space for you and your company.

Titanic Syndrome: Why Companies Sink and How to Reinvent Your Way Out of Any Business Disaster

Dr. Nadya Zhexembayeva

30 November, 2023

One of the most illustrative failures of all time: The Titanic. In fact, its story offers eerie parallels between the behavior of the ship’s team and that of teams in today’s at-risk companies.

The secret sauce: Why employee wellbeing is more important than ever

Mindspace

17 November, 2023

Employee wellbeing has become a major game changer in today's corporate world. Nurturing and sustaining a happy and healthy workforce creates a foundation for future business success. It’s a simple formula - when employees feel good, they are able to handle stress better, find focus, untap creativity and have a meaningful impact on their team and organization. Here’s everything you need to know before implementing a wellbeing program at work.

Your guide to Miami's Art Basel: unlock the ultimate art experience

Mindspace

7 November, 2023

The annual Art Basel Miami Beach art fair is one of the leading cultural experiences in North America. Considered by many to be the ‘Superbowl of the art world’, with so many must-see exhibitions and VIP parties, it’s a good idea to do your homework before you visit Art Basel. As leading providers of Miami coworking spaces at the heart of the action in the Downtown Miami and Wynwood neighborhoods, we’ve put together this guide to help you make the most of what Vanity Fair famously described as ‘the most raucous week in American arts’.

Fun Things to Do in Wynwood, Miami, After Work

Mindspace Community Manager

27 October, 2023

Wondering what to do in Wynwood, Miami, on your way to the office, at lunchtime, or after work? Well, this neighborhood is full of fun options to break your workday routine and fill you with inspiration. From tasty treats to astounding art, and onto stylish shopping sprees, you can consider yourself lucky if this is where you spend your nine-to-five.

Why Miami is Becoming a Hot New Tech Hub for Entrepreneurs

Mindspace

4 October, 2023

America’s party town is undergoing a radical transformation. Renowned for its vibrant culture, tropical beaches and enviable climate, Miami has long been a magnet for the mega-rich to own property and for students to celebrate the spring break. However, in recent years, this gateway city to Latin America has begun to attract a different demographic. Amidst the Silicon Valley exodus, tech founders and venture capitalists are flocking to Miami to take advantage of its lower living costs, diverse pool of talent and thriving entrepreneurial ecosystem. Forbes recently ranked Miami ahead of New York and Austin, Texas, for emerging tech hubs in the US. So what is it that’s driving this transformation?

Breast cancer awareness month activities in the workplace

Mindspace Community Manager

3 October, 2023

October is International Breast Cancer Awareness Month, making it an ideal time to raise awareness about this crucial issue at work. This potent catalyst for compassion can start with highlighting the courageous people in our midst and emphasizing the importance of assistance and solidarity. Understanding their challenges and offering support, including donations and practical help like hair services, uplifts the spirit and strengthens our workplace community. We gathered for you some simple yet impactful breast cancer awareness ideas for work.

The Best Areas in Miami for Your Next Flex Office Location

Mindspace

2 October, 2023

Renting an office in Miami will surely brighten your workday in the Sunshine State. Whether you’re looking for a satellite office or a new spot for your HQ, this sun-soaked, waterfront, multicultural, vibrant city is a great place to grow your business.

The Benefits of Renting a Fully Furnished Workspace

Mindspace

18 September, 2023

Finding the right office space for you and your team is a critical step for both company growth and employee happiness. Even in the new world of remote work, the office is still at the heart of a company’s culture. It plays a vital role in collaboration, collective innovation and worker wellbeing.

What is a hot desk? A complete guide to the hot desking concept

Mindspace

4 September, 2023

If you haven’t already, then say goodbye to your potted plant, framed family picture, and regular office desk… and hello to hot desking. While it’s certainly not a new concept for freelancers and startups, hot desking is a trend now being embraced by companies of all shapes and sizes looking to infuse more efficiency, flexibility, and creativity into their employee experience.

What to do in Brooklyn after work [city guide]

Mindspace Community Manager

21 August, 2023

Whether you’re a member at Mindspace Williamsburg in New York or looking to rent an office in Brooklyn, these recommendations of what to do in Brooklyn after work or when taking your lunch break are curated especially for you. We asked one of our local community managers about their favorite spots around.

Top 10 advantages of a high-tech coworking hub

Mindspace

17 August, 2023

A flexible office space can play the perfect host to a high-tech hub where entrepreneurs, founders and employees of big high-tech enterprises can all network and exchange ideas. Like-minded professionals find inspiration, along with the support they might need to grow their business, all the while focusing on improving their work-life balance. Find out what the top advantages are of coworking spaces and how they foster innovation and productivity.

Why Brooklyn is the Perfect Choice for Your (Next) New York Office

Mindspace

8 August, 2023

Brooklyn has become a popular destination for businesses seeking a perfect New York office location. It’s true that Manhattan has the Financial District and Wall Street, Times Square, Union Square and SoHo, but just across the East River lies a borough with all the needed ingredients for one of the best office locations in New York City. With its vibrant atmosphere, diverse community, and affordable office space, Brooklyn offers numerous advantages for companies of all sizes and industries. Let's explore why Brooklyn is the optimal choice for your next NYC office.

How to manage teamwork: tips from a consulting company #MemberSpotlight

Mindspace Member

19 July, 2023

We love individuality and people who do things differently. So we were delighted to sit down for some quick-fire questions with our valued member at our Mindspace location in Utrecht, the Netherlands - Gjerryt Leuverink - who is the Strategic Consultant and Managing Partner at the consultancy firm De Selectie (The Selection).

How to prioritize tasks for your business or employees

Mindspace

12 July, 2023

When those open tabs just keep piling up in your browser and in your brain, your to-do list can feel quite overwhelming. Luckily, we’re glad to share some helpful tips about how to prioritize tasks for your business, as well as for your employees. Yes, compiling a task list and devising a plan do add more work to your plate, but it’s worth it; putting effort into proper time management and prioritizing your tasks will eventually help you save time and get the job done.

#MemberSpotlight: Successful founders have these 5 things in common

Mindspace Member

2 July, 2023

When it comes to communications, successful founders all honed these 5 specific skills. If you're building your own business, learn what do do (and what not to do) according to Oliver Aust - one of Europe's top authors, podcast hosts and advisors on the subject.

Escape the Commute: 5 Reasons Your Company Should Consider Satellite Offices

Adi Weinberger

27 June, 2023

With return to office policies standing out as a polarizing topic between employers and employees, there is an evident demand for workplace flexibility. One trending approach, although not new, is the hub-and-spoke work model or the use of satellite offices. Part of the office hub-and-spoke work model, satellite offices offer many advantages for both employers and employees, as companies reach beyond the city’s boundaries - and sometimes even beyond the borders. Here is everything you need to know about satellite offices, and why your company should explore this option.

New campaign for your most inspiring office [Watch]

Mindspace

26 June, 2023

Recently, Mindspace shot a visual campaign to shine a light on the workplace that will get your creative juices flowing. Get inspired by our video produced with Warsaw-based Rebell Studio, and watch the behind the scenes clip to find out where all this magic is coming from.

Four Ways to Support the LGBTQ+ Community at Work - and Anywhere Else

Hannah Widera

22 June, 2023

There’s something very powerful about people gathering in one place for the same purpose. Fighting for a shared conviction. Standing up against oppression. To mourn. To love. Pride Month isn’t just about colorful parades. It’s about acknowledging the fights that so many people fought for equality and tolerance towards all forms of sexual orientation, identities and personal expression. And yet sadly enough, we’re still fighting homophobia, transphobia and biphobia today because, it hasn’t vanished from the world. And the workplace is no exception. So what can all of us do to support the queer community - especially around the workplace, where many of us are still hushing up difficult topics such as discrimination?

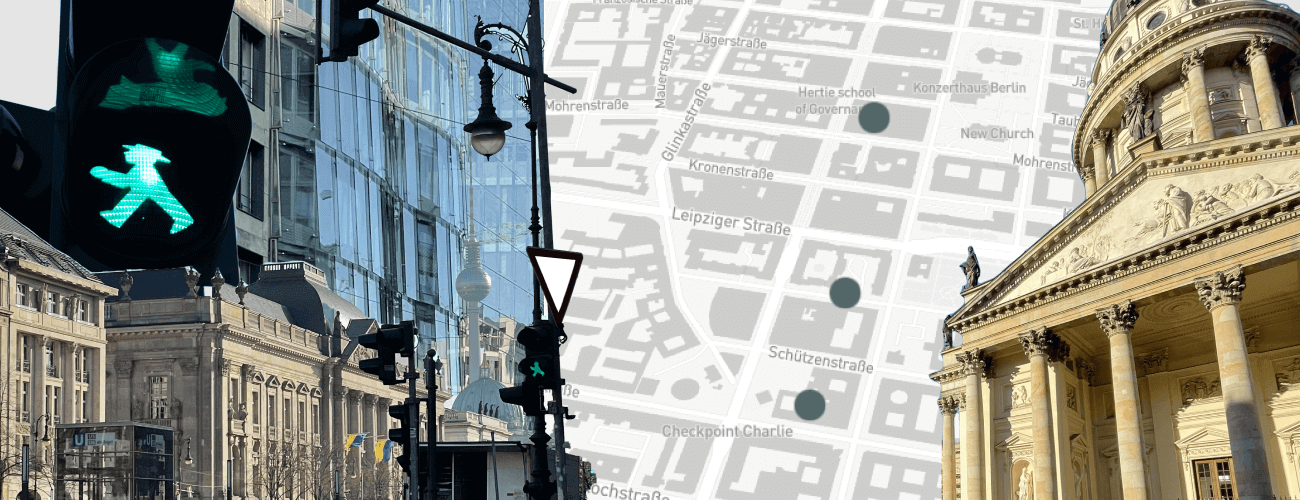

Then and now: The stories behind the buildings of Mindspace in Berlin

Mindspace

19 June, 2023

In a blast to the past, we take you on a fascinating journey into the histories and stories behind each of our Mindspace locations in Berlin.

The Future of Flex Spaces: Expert Predictions

Mindspace

5 June, 2023

We’d like to share some bold predictions from some of our favorite, highly experienced colleagues, alongside those from our esteemed leaders. We spoke to experts from the United Kingdom, Netherlands, Poland, Germany, Romania, and the USA.

The incredible benefits of standing while working at a desk

Mindspace

30 May, 2023

If your career involves long hours in an office, then you should consider a standing desk. Studies and experience show they make a positive difference in health and productivity. Sitting at a desk for long hours at a stretch impacts both physical and mental health whereas adding some standing hours to your day reduces the risk of obesity, cardiovascular disease, and diabetes. Your mental health, focus, energy, creativity, and maybe, your lifespan will all receive a welcome boost.

What is a virtual office? Exploring the Virtual Office Phenomenon

Mindspace

19 May, 2023

It’s no secret that the world of work has undergone a radical transformation over recent years, thanks to the advent of technology, changing work dynamics and a global pandemic. As businesses strive for greater flexibility, cost-efficiency, and a global reach, the virtual office has emerged as a game-changing solution. In this article we delve into the concept of a virtual office, explore its numerous benefits, and identify who can benefit the most from this innovative workspace model.

Shhhhhh! 5 ways to find peace and quiet in co-working spaces

Mindspace

11 May, 2023

Want to beat the home office blues but are worried about the potential distractions of a coworking space? Well, at Mindspace you can have it all! Here are 5 quiet and cozy solutions to finding zen and privacy at work.

#MemberSpotlight: Transforming work environments across Berlin

Mindspace

1 May, 2023

Contemporary, yet steeped in history, Berlin is one of our favorite cities. As we experience rapid growth, discover how Mindspace is transforming employee experiences across Berlin, and what our members love the most.

The Kwinta Factor

Mindspace

24 April, 2023

The larger-than-life Michal Kwinta is breaking new ground for Mindspace in Warsaw. Find out what makes our City Lead in Poland tick and why he's so excited about the launch of our second location in Warsaw, Mindspace Skyliner.

How to network on social media: tips for entrepreneurs

Guest Author

16 April, 2023

Where can you find friends, navigate a new career and build a community? The answer is simple: social media. Emily Claire Hughes, Hamburg-based marketing storyteller and the organizer of the “Women of Influence” networking event at Mindspace Rödingsmarkt, shares her insights. Learn how women in business and other entrepreneurs can leverage social media for networking and community growth.

The Hybrid Workplace: The Best of Both Worlds

Dana Ilovich

11 April, 2023

The hybrid workplace works for both small businesses who don’t need their own office, and for big ones with dispersed staff.

Walk to Work in Berlin Mitte: Walking Route Full of Sights

Ina Schmitz

7 April, 2023

Walking to work has loads of benefits. And if you live and work in Berlin, the benefits are even greater. Let Mindspace community manager Ina Schmitz walk you through her daily walking route through Berlin Mitte, filled with sightseeing and good vibes. Put on your walking shoes and read.

A complete rundown of how a Hybrid Workplace Works

Mindspace

4 April, 2023

The workplace has undergone a significant transformation over the last decade. With technological advancements and changing attitudes towards work, employees and employers alike have started to embrace the idea of a hybrid workplace. A hybrid workplace is one that combines remote work with in-person work, providing employees with the flexibility to choose where and when they work. In this blog post, we will provide you with a complete rundown of how a hybrid workplace works.

5 Biggest Myths About Coworking, Debunked

Noga Grinberg

2 April, 2023

Deliberating between a regular office and a flexible office (aka coworking)? This is a must-read for you.

Coworking Space: 8 Tips that Boost your Productivity & Focus

Mindspace

24 March, 2023

There’s no doubt about it, the energy and buzz of a coworking office is contagious. The boost of stimulation, collaboration and creativity you experience is better than a double espresso.

5 Tips for Improving Employee Wellbeing

Anat Zilberman

21 March, 2023

From promoting mental and physical health to showing employees how much they matter, ensuring employee wellbeing should be a top priority. Anat Zilberman, Mindspace Global Employee Experience Manager, provides five ways to boost employee wellbeing, along with useful examples to encourage wellness - and subsequently - productivity and engagement in the workplace.

5 No No’s When Working From a Shared Space

Mindspace

14 March, 2023

A shared office space is all about collaboration, networking and inspiration. At the same time, it’s also about getting the work done, and keeping in mind that although your desk is your kingdom - you have a lot of neighbors to consider and work side by side with. With that in mind, we’re bringing you the 5 no-go’s to avoid when working in an open space, as well as what to do instead, from the wisdom of our lovely community managers around the globe.

5 Best Lunch Spots Around Market Street, San Francisco

Jack Elder

4 March, 2023

It’s no secret that lunch is one of the most important parts of the workday, as well as a great office conversation starter. Jack Elder, Senior Community Manager at Mindspace San Francisco, shares his recommendations for some delicious lunch spots around Market Street. Warning: don’t read this on an empty stomach.

Attract Top Talent in D.C. with These 3 Core Values

Naama Adler

12 February, 2023

Fresh Survey of D.C. Office Workers uncovers what you can do to keep your teams satisfied and productive and lure in the best talent

Happy Employees, Happy Company

Dan Zakai

11 February, 2023

Mindspace CEO sheds light on how Design Thinking is reshaping the office real estate industry

How to Rent a Coworking Space as a Freelancer & Business Owner

Mindspace

6 February, 2023

In today's fast-paced business world, many companies are looking for flexible and cost-effective office space solutions. Coworking spaces have become increasingly popular in recent years as they provide an affordable alternative to traditional office spaces. In this blog post, we will explore the benefits of renting a coworking space, the average costs associated with these spaces, and the different types of coworking spaces available. We will also go over the process of renting a shared desk, private office, or team suite, as well as the office add-ons and conference rooms that are often included with these spaces.

A Brand New Out-of-Town Flex Office Space

Mindspace

5 February, 2023

Mindspace Park Ofer East in Petah Tikva is part of a growing trend to build flex offices outside of city centers, creating flexible and beautifully designed workplace environments that service large communities of high-tech workers.

The History of the Coworking Sector

Noga Grinberg

4 February, 2023

Take this tour into the brief history of time of the expanding flexible workspace industry

Plants in the Office: Why a Little Bit of Green Can Make a Big Difference

Noga Grinberg

30 January, 2023

Think you can’t be bothered to have a plant in the office? Maybe it’s time to rethink that. Plants not only look good, but they can have some real actual impacts on your life in the office. Read on to find out more.

A Management Guide: Giving Feedback to Employees

Mindspace

30 January, 2023

Feedback is an essential tool to nurture staff development and maintain engagement. For employees, working their way up the career ladder requires regular constructive feedback. They need to understand their strengths and weaknesses in order to fulfill their potential. For employers, it’s just as important to give regular feedback to improve performance, foster professionalism and maintain a healthy and productive work culture.

Woof! Meet Mindspace's Supermodel Dogs.

Mindspace

24 January, 2023

Our dog-friendly culture at Mindspace helps us create a work environment that lowers stress, increases collaboration and boosts employee morale. Our recent pet photo-shoot at Mindspace locations across Munich helps show why our furry friends infuse more love and joy into our workday.

#MemberSpotlight - 8 Simple Ways to Make the World a Better Place (Even Just a Little)

Edita Lobaciute

19 January, 2023

Every year 8 million tons of plastic end up in our oceans – by 2050 there will be more plastic than fish in the oceans. In order to preserve nature and improve our quality of life, it is enough to start with a few simple, yet effective habits.

What is Company Culture? - The Art of Strong Company Cultures

Mindspace

16 January, 2023

Company culture is at the heart of employee experience. It is made up of a combination of personality, core values and the behavior of an organization. A strong work culture is one that is motivating, nurturing and inclusive – which has a positive impact on innovation, productivity and employee retention. Culture dictates everything, from the way you feel about returning to work after the weekend, to how you react to any work issues that arise. Work culture can often separate the winners from the losers in a hyper competitive world where attracting and retaining the best talent is a constant challenge for companies.

Flex Office Space is in Demand: Here are the Reasons Why [Watch]

Mindspace

16 January, 2023

In an interview with i24NEWS, Mindspace CMO Efrat Fenigson talks about the flexible office space trends that accelerated during the pandemic. Benefiting both enterprises and landlords - flex is on the rise. Watch the full feature here.

The Art of Collaboration: Mindspace's Global Offsite in Berlin

Mindspace

14 December, 2022

Imagine the atmosphere when more than 170 Mindspace employees gathered together in Berlin for the Mindspace annual offsite last week. Flying in from 7 countries, our employees had the opportunity to meet their coworkers face-to-face for some bonding, brainstorming and celebrating.

10 Cool Places to Hangout Near Mindspace Ahad Ha'am (Tel Aviv)

Mindspace

12 December, 2022

Our trio of Community Managers at our flagship building in Ahad Ha'am are fully dedicated to helping cultivate the lifestyle that has become synonymous with the Mindspace employee experience. They take pride in being the point of contact for our local Mindspace community, and are full of tips for how to work hard and play hard at Mindspace Ahad Ha'am, and make the most of its unbeatable downtown location.

What Really Makes People Happy at Work?

Noga Grinberg

8 December, 2022

We surveyed 5,000 people around the world and asked them how they feel about work — what they look forward to at the office every day, what matters most to them at their jobs, and what their employers do for them.

The Future of Work

Dylan Springer

3 December, 2022

From cubicles and private offices to open spaces and the rise of freelancing and the gig economy, the nature of work today would be unrecognizable to anyone who retired just two decades ago. We sometimes laugh at the people who predicted, decades ago, that everyone would own a flying car and butler robot by 2000.

#MemberSpotlight - What is the Advantage of a Flexible Office Space

Mindspace Member

29 November, 2022

Is renting a flex office the right decision for your business? Andreas Fischer, CEO at minubo - a Mindspace member in Hamburg - shares his experience. Read his thoughts about coworking, starting from questions and doubts to his final decision of moving the company to a flexible office space.

Beat the Home Office Blues — What Freelancers Gain by Coworking

Ian Richter

25 November, 2022

The freelance workforce is constantly growing, with experienced professionals from a variety of sectors shifting into new modes of operation as independent contractors. While the default “work from home” setup might be perfect for some, many new freelancers find a lack of a dedicated work environment unsustainable over time.

#MemberSpotlight - Finding Space and Connection at Mindspace Hammersmith

Mindspace

24 November, 2022

With its welcoming community and vintage design vibes, Mindspace Hammersmith is a rising star in our global portfolio of locations. Read about why both home-grown and international businesses now call it home.

Tech Companies Discover the New Working World

Noga Grinberg

22 November, 2022

The advantages of coworking for tech companies are concrete and numerous. Tech companies that have already recognized this trend and belong to the global coworking community include Microsoft, Booking.com, Samsung, Siemens, and DB, to name a few.

The four best places to hang out in Shoreditch

Joseph Glenny

14 November, 2022

Where innovation meets diversity, Shoreditch is one of London's most eclectic and dynamic neighborhoods. With no shortage of restaurants and bars to choose from, Joseph Glenny, our Community Manager at Mindspace Shoreditch, gives us the low down on his favorite places to grab a bite to eat or mingle over afterwork drinks.

5 Workspace Improvements That Boost Employee Productivity

Leeyha Laor

11 November, 2022

Fresh Report on Office Worker Needs uncovers what you can do to keep your teams satisfied and productive

Black History Month: The Domino Effect of Community Empowerment

Mindspace

7 November, 2022

True community building requires an open, inclusive and culturally diverse approach. Learn about the outreach by Helen Woldemichael, Community Manager at Mindspace Hammersmith, to mark Black History Month in the UK, and about the positive impact of sharing personal stories and celebrating different ethnic identities.

The Role of Interior Design in Today’s Offices

Ian Richter

4 November, 2022

From the width of the corridors to the color of the lampshades, the interior design of an office is very influential when it comes to a company’s performance and its impression on visitors

Coworking: How Did It All Start and Where Is It Going?

Noga Grinberg

4 November, 2022

A brief look into the history of coworking — a work trend long on the rise, bringing together professionals from across all industries to form inter-connected communities

7 Mindfulness Tips to Get You Through the Day

Maayan Samuni

3 November, 2022

We have all the tools we need, we just don’t use them all the time. By practicing only some small mindfulness exercises throughout the day, you can get your mind to focus on what’s in front of you

The Psychology of Coworking: Social Support and Self-Efficacy

Naama Adler

1 November, 2022

The benefits of social support within a coworking environment and how it can lead to improved performance.

Coworking: The End to Your Office Overhead Nightmare

Ian Richter

1 November, 2022

Thanks to coworking, both SMBs, and large enterprises are enjoying the huge relief that comes with completely doing away with a long list of overhead expenses

Nurturing Company Culture Within a Coworking Space

Noga Grinberg

31 October, 2022

It’s been recognized that today’s companies, whether budding startups or established enterprises, need to invest in creating their own unique culture, and nurture it.

How to Beat the Mid-Work-Day Slump

Naama Adler

31 October, 2022

We’ve all been there: the clock hits 3:30 pm and so begins the long stretch to finish your workday while trying to maintain your productivity. Other than going for your third (or fourth) cup of coffee, here are five ways to boost your energy, refocus your mind, and end your workday on a high.

#MemberSpotlight - How Mindspace Makes My Life as a Founder Easier

Mindspace

30 October, 2022

How can Mindspace help you do your job better? Carrie Filipetti founding Executive Director of The Vandenberg Coalition shares her experience at our lively Washington DC location. Read her thoughts about what makes Mindspace unique and why she continues to refer her peers to our offices.

The Ecosystem Project: the Players of the Israeli Tech Industry

Adi Weinberger

19 October, 2022

Showcasing some of the interesting players in the Israeli entrepreneurship landscape, The Ecosystem Project book was published to make an impact. As part of this fascinating mosaic that influences both on a local and global scale, Mindspace had the honor of being featured under the ‘Hubs’ section. We asked Erez Gavish, one of the book’s creators, why he decided to go ahead with this project. Read the full interview here.

Secrets to Career Success by Leading Women in Tech

Mindspace

18 October, 2022

On October 12th we hosted a Women in Tech business panel at our event space at Mindspace Shoreditch in London. The panelists were invited to share about what they wished they had known at the start of their tech careers. The event was a great success, the audience was really engaged in the discussion and refreshments, like pineapple cider by Brewdog-owned cider brand Hawkes, were enjoyed by all.

Mindspace Impact: Transforming a Community Space for Youth at Risk

Mindspace

28 September, 2022

The makeover process at the Elem foundation was led by Mindspace’s design team, with the intention of creating a safe and nurturing space where Elem community members could gather. They created a design plan to match its young inhabitants’ tastes and sensitivities. The work was focused on the ground floor which features a lounge and seating areas. The makeover went perfectly, transforming the place from an outdated building to a colorful, warm home for its young residents.

How to Build a Team of Committed Employees Through Emotional Connection

Leeyha Laor

9 September, 2022

Each business aims to have a fully engaged workforce. After all, engaged workers produce more, are less likely to quit, and are more likely to go the extra mile to make customers happy. But what does employee engagement actually mean?

How Creative Workspace Design Encourages Productivity

Dari Shechter

3 September, 2022

Studies have shown that design-led organizations significantly outperform those that are not design-led, over the long term. Discover how your agency can integrate Design Thinking principles to catapult creativity and innovation.

#MemberSpotlight - Social Media Trends and Challenges in 2024

Mindspace Member

29 June, 2022

TikTok or Instagram Reels? Which influencer should you work with? And is the Metaverse worth investing in? 2023 is fascinating in terms of social media trends and challenges. Karolina Kornacka, Head of Content and Social Media at Kamikaze Altavia Group - our member at Mindspace Koszyki in Warsaw - shares five insights worth paying attention to this year.

Personal Branding to Future-Proof Your Career

Oliver Aust

27 May, 2022

Today, mastering communications is not simply a matter of adding another string to your bow. Communication has become a fundamental or hard skill not just for communicators, but also for CEOs, executives, and anyone with ambition.

#MemberSpotlight - A Day in the Life of a Mindspace Member in Philadelphia

Mindspace Member

18 May, 2022

What is it like to get up in the morning and go into the office at Mindspace Wanamaker? Our member Emily Hauser of Straker Translations shares her typical workday at her office space in Philadelphia. Learn about her Mindspace experience, and find out what’s so great about working flex in Philly.

How to Start the Conversation About ESG in Your Company

Aurelie Amidan

17 April, 2022

This year’s Earth Day theme is ‘invest in our planet’. And what a better way to make a meaningful impact than to start developing Environmental, Social and Governance (ESG) standards in your organization? Mindspace Director of Strategy and Corporate Development spills all the beans about how to bring ESG initiatives to the company’s table. Read this guide, and let’s invest in our planet and community together.

#BreakTheBias in the Workplace [Watch]

Adi Weinberger

1 March, 2022

The theme for International Women’s Day 2022 is #BreakTheBias. An implicit bias is an unconscious tendency to pick one gender, race or another group over another. At Mindspace we can proudly say that employees are hired and promoted according to their capabilities, leaving any bias behind. We asked our executives what men can do to break the gender bias at the workplace. Read their responses, and watch a riddle that might put your preconception to the test.

#MemberSpotlight - on Adaptation, Empathy and Authenticity in Leadership

Hannah Widera

12 February, 2022

How to be a successful leader, and keep your employees motivated? Leadership coach and Mindspace Hamburg member Paul Weißhaar has recently published his first book, “The Chameleon Method”, where he spills the beans about being a good leader. We asked him for tips and advice on good leadership and its importance in today’s professional environment. Read the full interview.

#MemberSpotlight - Mindspace Yakum’s First Members Share Their Experience

Sivan Gilad

30 January, 2022

Mindspace’s very first Israeli location out of the city recently opened its doors. After a long time of coworking and flexible office spaces being associated with prominent cities and urban areas, leaving the hustle and bustle behind gives a breath of fresh air with its countryside charm. We asked five of the first members who joined Mindspace Yakum about their experience so far. Find out why they chose this location, and how they believe flex contributes to their companies’ growth.

Watch: Mindspace's Hidden Gems Featured on Channel 13 Israel

Adi Weinberger

1 November, 2021

Mindspace’s secret rooms got some screen time on Israel’s Channel 13. From a podcasting studio to a rooftop for yoga activities and even a nap room, our Ahad Ha’am branch has it all. Watch the full feature here.

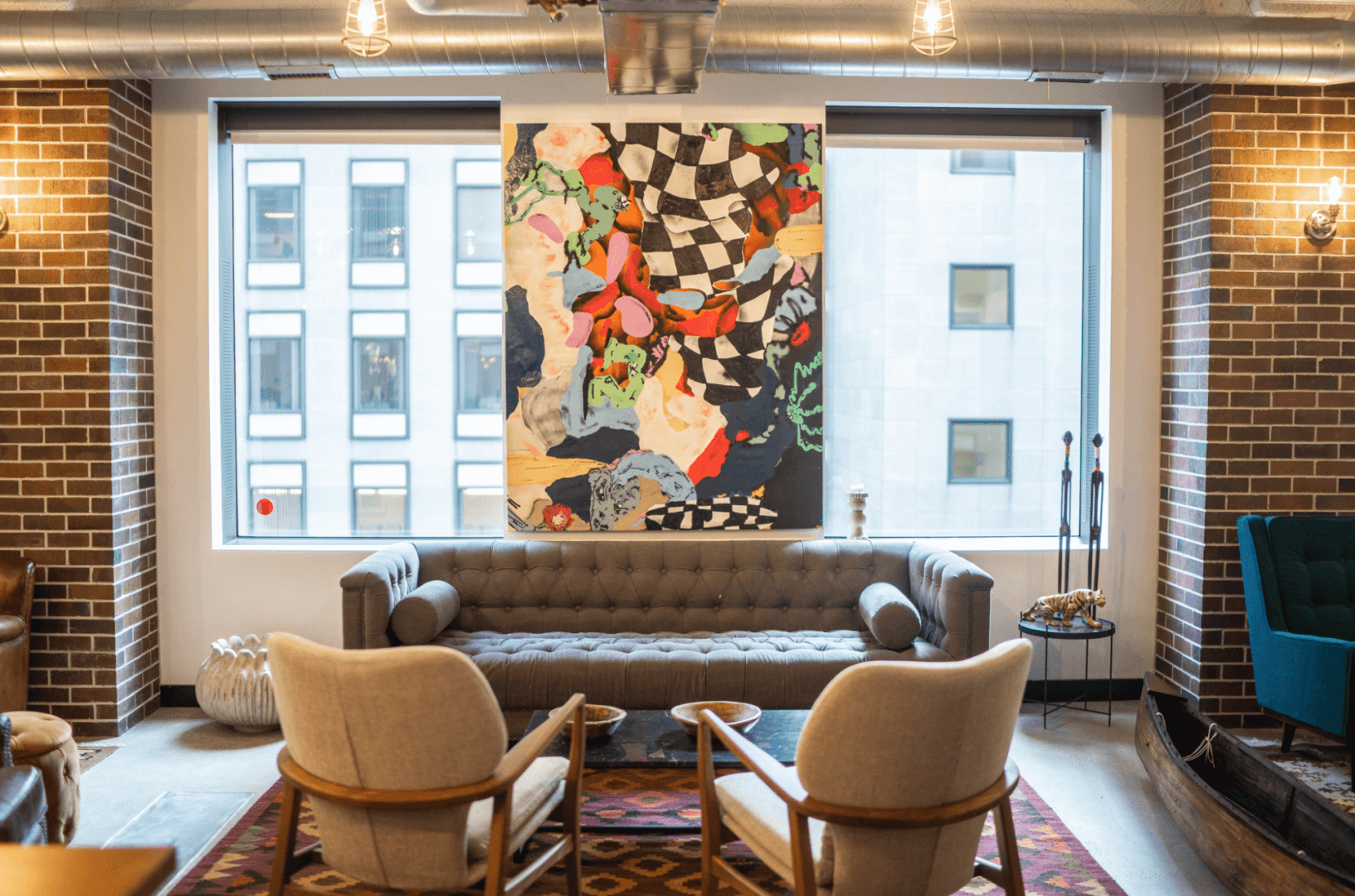

Decorating Mindspace With Dari Shechter

Nicole Nanikashvili

17 August, 2021

Ever since its foundation in 2014, Mindspace has been driven by its unique DNA and love for art and quirky design. For the recent opening of our La Guardia branch, we followed Dari Shechter, VP Creative and Design at Mindspace, for a peek behind the scenes and to better understand the process of 'How We Decorate Mindspace'. Experience the journey as we walk through the Jaffa Flea Market in Tel Aviv and she has a heart-to-heart with local business owners who struggled during the many lockdowns of the pandemic.

How To Tell If You’re A Workaholic

Revital Moses

5 July, 2021

Over the years, people have come to prioritize their work over their health, family time and - above all - themselves. While the sense of ‘being busy all the time’ might make you happy at first, at some point it will catch up on you. And if you’ve long skipped the happy part and it’s already affecting your mental health - and physical health - it’s time to rethink and shift your priorities.

#MemberSpotlight - The Long-Term Cost Savings When Using Renewable Energy

Edita Lobaciute

17 December, 2020

At the simplest level, renewable energy allows us to dramatically reduce society’s CO2 emissions. But it also helps to improve air quality that suffers from the particulate matter and polluting gases that inevitably come from burning fossil fuels.

#MemberSpotlight - The Secret Weapon to Turbocharge Your Career

Emma Hogan

29 November, 2020

Can indoor cycling improve your intellect? Could squats make you more successful? Will weight lifting make you wealthy? Science suggests that if you start working out regularly, you won’t just boost your health and fitness – you’ll make gains at work and in other areas of your life.

#MemberSpotlight - Personal Branding: It's Not Enough to Just Do a Good Job Nowadays

Sandra Winkler

19 November, 2020

Oliver Aust, author and CEO of Eo Ipso, talked to us about personal branding, and why becoming unignorable is about helping others rather than promoting yourself.

Why Tech Startups Should Choose Coworking Spaces

Dan Zakai

30 October, 2020

Coworking spaces are currently disrupting the traditional office and the advantages for tech innovators are concrete and numerous.

How to Save $240,000 on Your Office Real Estate in Three Years

Mindspace

15 September, 2020

Flex space could save companies up to 60 percent in costs, which can be invested in building the business. In such a challenging time from a financial perspective, that’s significant. Rather than gambling, there’s now an algorithm to better understand your office space investment risks.

The Workspace of Tomorrow

Oliver Lehmann

2 September, 2020

The Corona crisis makes it clearer than ever: our working world no longer functions as it does at present. It must become more flexible and agile in order to continue to satisfy employees and offer them a good working environment.

Traditional vs. Flex-Office: San Francisco, Private Office, 10 People for 2 Years [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Munich, Private Office, 4 People for 2 Years [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Tel-Aviv, Private Office, 5 People for 1 Year [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Berlin, Private Office, 4 People for 1 Year [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: London, Private Office, 10 People for 1 Year [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Bucharest, Private Office, 15 People for 2 Years [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Amsterdam, Private Office, 5 People for 1 Year [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Traditional vs. Flex-Office: Warsaw, Private Office, 8 People for 1 Year [Infographic]

Dana Ilovich

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision

Rethinking Your Office Choice? Make a Calculated Decision

Efrat Fenigson

27 August, 2020

Easily compare the cost of a traditional office lease versus a flexible office solution and have the data to make an informed decision.

#MemberSpotlight - The Story of Applied at Mindspace

Dana Ilovich

21 June, 2020

Applied, a global software company that provides unbiased recruitment tools that help businesses implement a fair and inclusive hiring process, was starting to grow and like many startups that are scaling, needed a bigger and better office accommodations.

Are Flexible Spaces the Future of Work?

Shai Fogel

11 June, 2020

Yes, we know. A large communal shared open space, full of people. Most of these people are freelancers or small startups. Maintaining social distancing or privacy in such an environment is a challenge. Now think again.

Opening a Branch in Bucharest? This Could Be Your Best Office Option

Itay Banayan

19 January, 2020

Think coworking space is just for freelancers and startups? Think again. Major leading companies around the world are putting departments or select teams in coworking spaces so they can realize the benefits of these creative, innovative environments.

Michał Kwinta on Happiness at Work in Poland

Maayan Samuni

16 January, 2020

Michał Kwinta, Senior Community Manager at Mindspace Warsaw, was recently featured in an interview with Newseria, the Polish multimedia information agency. Michał talked about Mindspace’s recent Happiness Survey and what happiness means for workers in Poland.

8 Best Lunch Spots Around Friedrichstraße

Maayan Samuni

10 December, 2019

We all know Kreuzberg and Prenzlauer Berg have amazing restaurants on almost every corner, but you’ll be surprised at the great lunch-places Friedrichstraße has to offer.

Office Lighting Guide: Can it Lead to Brighter Ideas?

Maayan Samuni

28 November, 2019

is incredible to see how much lighting plays a part in our efficiency and creativity at work. As humans, our daily life cycles and metabolisms are closely linked to the light in our environment.

Leverage the Planet: The Benefits of Working from Different Locations

Ian Richter

24 November, 2019

Working in different locations has a lot of advantages, and can be a catalyst for progress as we’re constantly presented with inspiration, without having to search for it

5 Common Mistakes Recruiters Make in Job Interviews

SQLink

3 November, 2019

Recruiting new employees? — Be careful not to fall into one of the five most common mistakes in recruiting.

#MemberSpotlight - The Story of Exxeta in Munich

Dana Ilovich

2 November, 2019

When people are your top priority, choosing the right office environment becomes the main criteria.

#MemberSpotlight - The Story of Redbubble at Mindspace

Dana Ilovich

30 October, 2019

Redbubble opts for coworking to grow at ease while expanding their team based in Berlin.

Down the Road: Mindspace Amsterdam - Top 5 After Work Drinks

Sara Martin Mazorra

29 October, 2019

In our “Down The Road” series, we review places of interest and leisure surrounding Mindspace locations, so you can get the most out of the city.

Design Spotlight: Our Experts Reveal Their Design Secrets

Dylan Springer

29 October, 2019

[Exclusive Interview]: Mindspace VP Create & Design, Dari Shechter, dishes on design inspiration, stories, and insights that make each space special.

13 Books For Startup Founders

Maayan Samuni

12 September, 2019

We’re rounding up the literature leaderboard with some of our top picks for startup founders and those entrepreneurially minded. Check out this shortlist for books on how to develop a winning product, foster effective teams, create a thriving company culture, and guarantee the future success of the companies you build.

Why Utrecht Is Attracting Enterprises Like Yours

Naama Adler

11 September, 2019

With over 1,000 foreign companies, learn why Utrecht is one of Europe’s most competitive regions, and why it may be time your organization sets up shop.

Is Your Non-Profit Maximizing Its Workspace?

Naama Adler

10 September, 2019

Big-picture issues exist for Non-Governmental Organizations (NGOs) when selecting a workspace. Will the new location and set up help us drive forward the mission and serve our constituents?