Venture Capital in Miami: Your Guide to the Key Players on the Scene

Miami, Florida, has quickly established itself as a city of opportunity for entrepreneurs and investors alike. You may immediately associate Miami with its nightlife and sun-soaked beaches, but it has also become home to an active tech scene where new businesses are thriving. The wide range of venture capital firms based in Miami has also created the ideal environment for new companies to scale. According to an annual Venture Capital Insights report, this growth won’t be slowing down anytime soon. In 2023, South Florida startups attracted $2.41 billion in investments, ranking Miami as 7th in the nation for the number of venture capital deals made. And if you’re considering basing your business in Miami, it’s a smart move: Startups in the Greater Miami-Fort Lauderdale metro area secured 69% of Florida’s venture capital funding. There is a clear push for growth on home turf.

Miami is also in the midst of a real-estate boom. Are you looking for office space in the city? In that case, you’ll have plenty of options — including Mindspace Wynwood and Mindspace Downtown Miami, which offer prime locations for entering the start-up and venture capital scene. Whether you’re seeking funding for your new start-up, or looking to diversify your investment portfolio, you won’t want to overlook this city. Below, we’ve laid out a helpful guide of some of the top venture capital firms in Miami (listed in alphabetical order) to give you a jump start on your growth journey.

Antares Capital Corporation

Industry Focus: Antares provides funding for a diverse range of industries including Healthcare, Business Services, Tech, and Financial Services.

Investment Stage: Seed, Early Stage, Later Stage, PE Growth/Expansion, Buyout.

Investment Range: $500,000 to $5 million.

Antares Capital Corporation is an established venture capital firm with over 25 years of experience. The firm focuses on providing funding for private, equity-owned businesses and contains one of the most diverse portfolios, including companies like Delphix, a data platform that helps businesses protect sensitive data.

Fuel Venture Capital

Industry Focus: Technology and tech-driven companies.

Investment Stage: Seed and Early Stage.

Investment Range: $100,000 to $10 million.

Fuel Venture Capital is a trusted venture capital firm founded in 2017, with a commitment to being founder focused and investor driven. The firm is passionate about backing innovative business founders and providing investors with a diverse portfolio of tech driven, creative companies. Notable portfolio companies include Tradeshift, a B2B e-commerce network, and Lunar, a 100% digital bank.

H.I.G. Capital

Industry Focus: H.I.G Capital provides funding to a wide range of industries including Aerospace/Defense, Automotive, Healthcare, Food and Beverage, and Tech.

Investment Stage: Seed, Early Stage, Growth.

Investment Range: $10 million to $100 million.

H.I.G. Capital was established in 1993 and is a private equity and alternative assets investment firm focused on providing capital to small and mid-sized businesses to support their growth. The firm takes a collaborative, partner-based approach to private equity investment to drive active returns for their investors. It also has several notable portfolio companies, including Novadaq, a leading provider of imaging systems used in surgical procedures.

Krillion Ventures

Industry Focus: Health tech, Financial Services, Real Estate, Transportation, and Logistics.

Investment Stage: Early Stage Seed, and Series A.

Investment Range: Not publicly listed, varies on a deal-by-deal basis.

Krillion Ventures is “seeking one in a krillion” and — true to its tagline — is on a mission to find visionary entrepreneurs who want to turn their innovative ideas into profitable companies that will significantly impact their consumers and their respective industries. Notable portfolio companies include HomeLight, a real estate technology company connecting home sellers with buyers, and DeepBlocks, a platform using AI to automate real estate development.

LAB Miami Ventures

Industry Focus: Real estate and Construction Technology.

Investment Stage: Pre-seed, Seed, and Series A.

Investment Range: $100,000 to $500,000.

LAB Miami Ventures is a startup studio and venture capital firm committed to accelerating the growth of real estate and construction technology companies. In addition to offering in-house services to help entrepreneurs build new technology and scale their businesses, the firm also provides the capital needed to do so. It has several notable real estate portfolio companies, including Beycome, a real estate listing and transaction platform.

Miami Angels

Industry Focus: Technology

Investment Stage: Industry agnostic, focusing primarily on post-product, post-revenue, early-stage technology companies.

Investment Range: Not publicly listed.

Miami Angels was founded in 2013. It is a membership-based firm known for its collaborative investment model, which partners with an extensive network of angel investors to support startups. The firm is committed to fostering a diverse startup community in Miami, offering entrepreneurs mentorship, industry connections, and strategic advice via its angel investors. Notable portfolio companies include Caribu, an interactive video-calling and activity platform focused on families, and P3 Technologies, bringing digital solutions to the pet care industry to improve pet health and wellness.

Montrose Capital Partners

Industry Focus: Biotechnology, Pharmaceuticals, Medical Devices, AI, Robotics.

Investment Stage: Seed.

Investment Range: $10 million to $50 million.

Notable Portfolio Company: ViewRay

Montrose Capital Partners is a privately held company focusing on high-growth, early-stage companies. It believes that having access to public markets provides growth opportunities for both portfolio companies and its investors. Notable portfolio companies include ViewRay, a medical technology company developing advanced radiation therapy systems, and Enumeral Biomedical, a company focused on immune-oncology drug discovery.

Ocean Azul Partners

Industry Focus: B2B Software, Deep Technology, Applied AI, Connectivity Technologies.

Investment Stage: Seed, Early Stage.

Investment Range: $250,000 and $2 million.

Ocean Azul Partners is an early-stage venture capital firm established in 2017. It offers entrepreneurs both financial and strategic support to bring their technology-based solutions to life. Ocean Azul’s team plays an active role in their investments and has board seats on most. Notable portfolio companies include itopia, a desktop, app, and server automation system for Google Cloud Platform, and Forrest Innovations, providing agtech and biotech solutions to combat mosquito-borne illnesses.

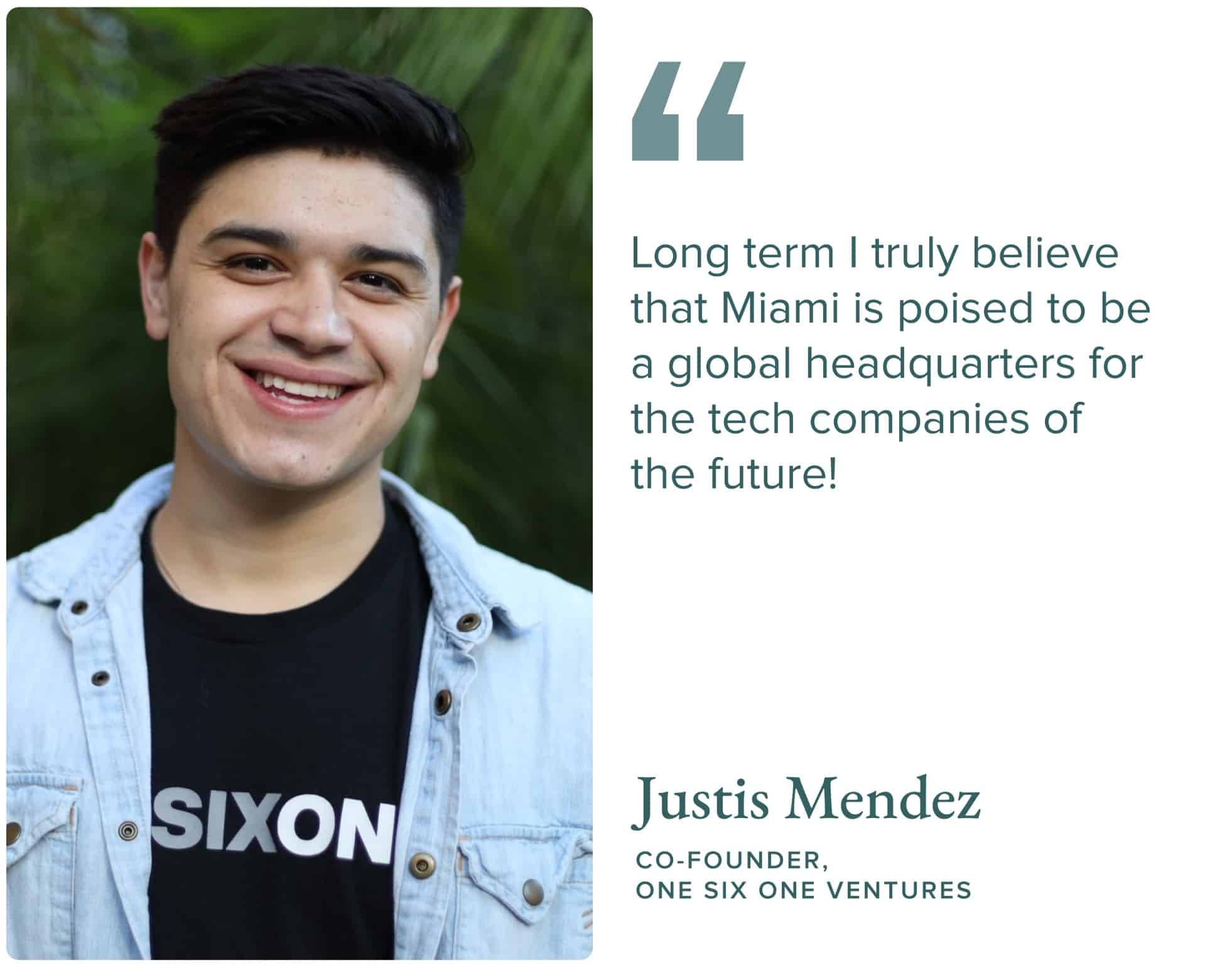

OneSixOne Ventures

Industry Focus: GovTech, B2B SaaS startups

Investment Stage: Pre-Seed

Investment Range: Not publicly listed.

Founded in 2017, OneSixOne Ventures is a pre-seed venture capital firm specializing in enterprise software and government technology startups. The firm is committed to building a community for startups to grow organically and efficiently. The firm has a wide range of portfolio companies, including Flair Labs, an AI company for audio processing workflows, and Ease Alert, a company of pre-alert wearables for first responders.

Rokk3r

Industry Focus: Technology, Web3, AI.

Investment Stage: Private Equity

Investment Range: $20 million to $50 million.

Rokk3r takes a holistic approach to supporting entrepreneurs. The firm combines venture building and corporate innovation solutions to help founders stay competitive and adapt to market changes, along with venture capital investments to help startups go from concepting to market-ready products. The firm has several notable portfolio companies in the tech space, including Taxfyle, an affordable, peer-to-peer tax filing platform, and Hyp3r, a marketing tech startup focused on the travel industry that was named as one of the world’s most innovative companies by Fast Company for several years in a row.

Secocha Ventures

Industry Focus: Fintech, HealthTech, Consumer Products.

Investment Stage: Early Stage, Pre-Seed, Seed, Series A.

Investment Range: $5 million to $10 million.

Secocha Ventures is a Miami venture firm founded in 2013, and focuses on early-stage investments in the B2C space, predominantly in the FinTech, digital health, and consumer products and services sectors. The firm has been praised by its partners for being both collaborative and transparent. It’s also known for supporting the local entrepreneurial community in Miami, regularly offering mentorship and engaging with local startups in the area. Notable portfolio companies include CarePredict, a company that provides monitoring solutions to improve the quality of life for senior citizens, and Brigit, a credit builder service that helps individuals get their finances on track.

Starlight Ventures

Industry Focus: Science, Technology.

Investment Stage: Pre-Seed and Seed.

Investment Range: $100,000 to $5 million.

Starlight Ventures partners with entrepreneurs using cutting-edge science and technology to improve human and planetary health while unlocking future economic growth potential. The firm provides its portfolio companies with ongoing strategic guidance, and helps founders make connections with future, right-fit investors. Notable portfolio companies include Gathered Foods, a company producing “plant-based” fish products, and Satellogic, specializing in the development of high-resolution satellites to observe the Earth.

As the startup scene in Miami continues to grow and evolve, there are always new players coming onto the scene — and new opportunities for funding and growth. If you’re considering expanding your investment portfolio or seeking a place to run your new business operations, Miami is the place and now is the time. Our two Mindspace locations in Wynwood and downtown Miami offer prime spots for you to conduct your business, offering several solutions to meet your needs, including private offices, large suites, and boutique meeting rooms.

Interested in becoming a member? Learn more about our Miami coworking options.